Why Brand Matters in VC

This article was contributed by Emily St. Denis, Head of Platform for Female Founders Fund. This was originally published on the Female Founders Fund’s Medium account. You can hear more about brand in venture capital by tuning into Emily’s interview on the Better Product Podcast.

Female Founders Fund launched in 2014 with one simple belief: women will build the companies of tomorrow. Since I joined the team as Head of Platform in 2018, we’ve invested in industry-leading companies like Kin Euphorics, Lex, RadSwan, and REAL. We’ve also had two notable exits: Eloquii to Walmart in 2018 and Billie to P&G in 2020. Over time, Female Founders Fund has become the leading source of institutional capital for female founders raising seed rounds.

As a small seed fund with less than $100M AUM, how has this been possible?

How we got here…

Since the beginning, our focus on building a brand has been FFF’s key differentiator, giving us the ability to punch above our weight class with limited resources. When FFF was started by our founding partner/entrepreneur Anu in 2014 as a $5.85M fund, instead of a traditional first VC hire (like an analyst), the team’s first hire was a Director of Community. Why? Because the primary goal was to build a brand strengthened by a community of female founders. Since then, the decision to prioritize Platform has come back multifold, increasing our access to proprietary deal flow, supporting an engaged network, and creating a tight-knit community of female founders and entrepreneurs.

Hosting high quality events has been another important part of our early strategy. In 2013, we hosted our first-ever “Meet NYC’s Female Founders” event. By co-hosting the evening with much larger funds like Bain Capital Ventures, First Round Capital, Union Square Ventures and others, FFF was put on the venture map and elevated our name by peers who had much greater institutional connections and AUM.

With the success of entrepreneur-led funds like First Round, Lerer Hippeau et al in NYC, the values and ethos within the ecosystem shifted from the POV of the investor to the founder. As an operator-led fund ourselves, this has not only shaped our strategy but how we’ve allocated our resources as well.

As FFF matures, we continue to ask ourselves: how can we grow our network and position ourselves as leaders in the ecosystem? How do we make sure that FFF is the first place that female founders come to when embarking on a fundraise? What do female founders really need from a Platform strategy — and how can we continue to push the boundaries of what’s possible?

Since we are not always competing with check size, we have to be creative in aligning ourselves among our peers. With this in mind, we take a different approach to “Platform” by positioning FFF not only as a fund, but as a brand and community.

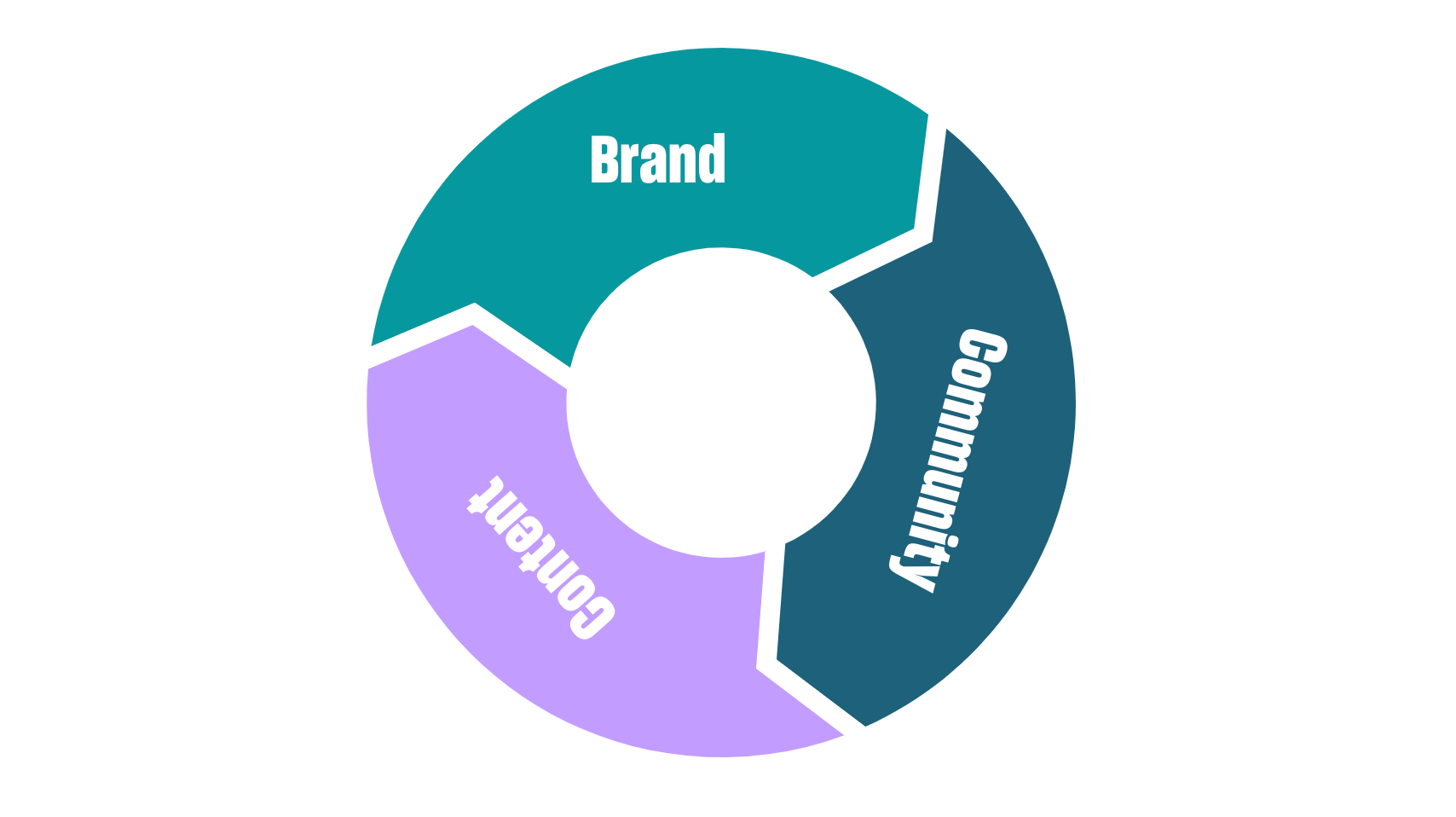

Over the years, we’ve built a reputation by focusing on the following:

- BRAND: A punchy, differentiated aesthetic a la Billie

- COMMUNITY: A tight-knit community a la Glossier

- CONTENT: Aspirational content strategy a la Goop or The Wing

In my opinion, with hundreds of seed funds now in the market, it has never been more important to differentiate how your fund is relevant to potential founders. By focusing on the circular nature of how brand grows community, community feeds content, content reinforces brand and back again, we’ve grown a network that includes women like Melinda Gates, Anne Wojcicki, Whitney Wolfe Herd, Serena Williams and others; increased our access to diverse deal-flow resulting in investments with above-average returns; and accelerated our founders’ growth.

Here’s how.

Brand

Like any startup, having a differentiated aesthetic helps us stand out and situate ourselves within the ecosystem. Plus, we are a fund with an investing thesis that, frustratingly enough, still trips some people up in 2020. It’s important, then, for us to communicate who we are — and what we stand for — with just a glance at our logo or a scroll on Instagram.

In FFF’s brand refresh completed this past Spring, we were intentional about our thesis that investing in female founders is simply good business — and we have the stats to back it up.

A few examples include:

- Highlighting our track record of strong returns on our website homepage;

- Spotlighting the women behind the investments on our website’s portfolio page; and

- Communicating strength and fearlessness in our mission via our strong “F” logomark, assertive fonts, and angular imagery.

An added bonus of prioritizing branding is that it gets us closer to our founders’ journeys. By going through the same processes, we are tapped into the best talent, freelancers, agencies, web designers, etc., in the space and can vouch for them firsthand. We’re on the ground hustling alongside our companies; we can relate, because we’re building something too.

Community

Along with the standard challenges of starting a company, female founders experience a unique set of hurdles, especially the inaccessibility (and elusivity) of the “old boys club.” To help our founders develop and scale a powerful network as quickly as possible, we run 30 to 40 events a year to provide opportunities for targeted networking, brand visibility, and learning from industry leaders. For FFF, events are necessary to make connections that lead directly to dealflow and helpful connections for our community. Past examples include:

- Zola founder Shan-Lyn Ma met LSVP partners at one of FFF’s first Meet NYC’s Female Founders events. This connection resulted in LSVP leading Zola’s Series C round.

- Winky Lux founder Natalie Mackey attended a FFF panel as an audience member, where she was introduced to FFF founding partner Anu Duggal. The conversation led to FFF leading Winky Lux’s $2M seed round.

- Google/Yahoo! alum Marissa Mayer was the keynote speaker at FFF’s CEO Summit. At the Summit, Marissa was introduced to FFF portfolio company The Wonder, in which she later invested.

As a fund investing in companies with particularly engaged social communities (Co–Star, Peanut, and Lex to name a few), it’s also important that FFF demonstrates we understand how to build our own lasting relationships and can optimize our network. Since VC can be esoteric to those outside of the ecosystem, we run our Instagram and social accounts more like a brand would — providing friendly, informational, and relatable content that encourages interaction. Connecting with our growing social community results in brand awareness and recognition for FFF, and also informs aspiring entrepreneurs about the venture space — increasing our access to diverse dealflow. By making an effort to be visible on the platforms that founders frequent, FFF stays top of mind and has led to direct DM’s from founders about to raise capital. To break down the “warm-intro” bias, we’ve found it’s just as important to go where the people are as it is having them come to us.

Content

To keep the community we’ve built connected and engaged, our content strategy is centered around the stories of women who are breaking down boundaries and building the companies of the future. Along with notable founder and LP interviews, event invites, and funding announcements, we’ve taken inspiration from brands like Goop and The Wing by introducing lifestyle pieces (like our Holiday Gift Guide and Self-Care Tips) to better personalize the woman behind the brand.

Our podcast, The 2% (launching Fall 2020), is inspired by the fact that historically less than 2% of venture capital funding has gone to female founders. We’ll be featuring exclusive interviews with seasoned entrepreneurs/investors and rising stars changing the technology industry, and we are excited to connect with our community and grow our reach in a new way.

By balancing the interests of aspiring and existing founders, VCs, LPs, and the general public, we’re able to reach a wide audience and find something that resonates for everyone.

And so, FFF’s Platform cycle continues.

While every fund’s investment thesis should inform their Platform strategy, as investors in female founders we believe that focusing on brand, community, and content has allowed us to:

- Set ourselves apart from other funds, increasing our access to deal flow and to a set of phenomenal diverse founders;

- Grow and strengthen our network, resulting in new relationships with potential portfolio founders, investors, and acquirers; and

- Connect with leaders in the space and stay top of mind within the ecosystem.

At the end of the day, creating a “brand” is about having a product with a unique POV on the world and growing a community around it. We believe that our clearly differentiated strategy of investing in women will generate above market returns — and the prioritization of brand is an integral part of that. We’re excited to continue supporting our network and hustling alongside our founders to build the businesses of the future — because after all, we can relate — we’re building something new, too.

To learn more about the importance of brand in VC, check out Emily St. Denis’s interview on the Better Product Podcast.